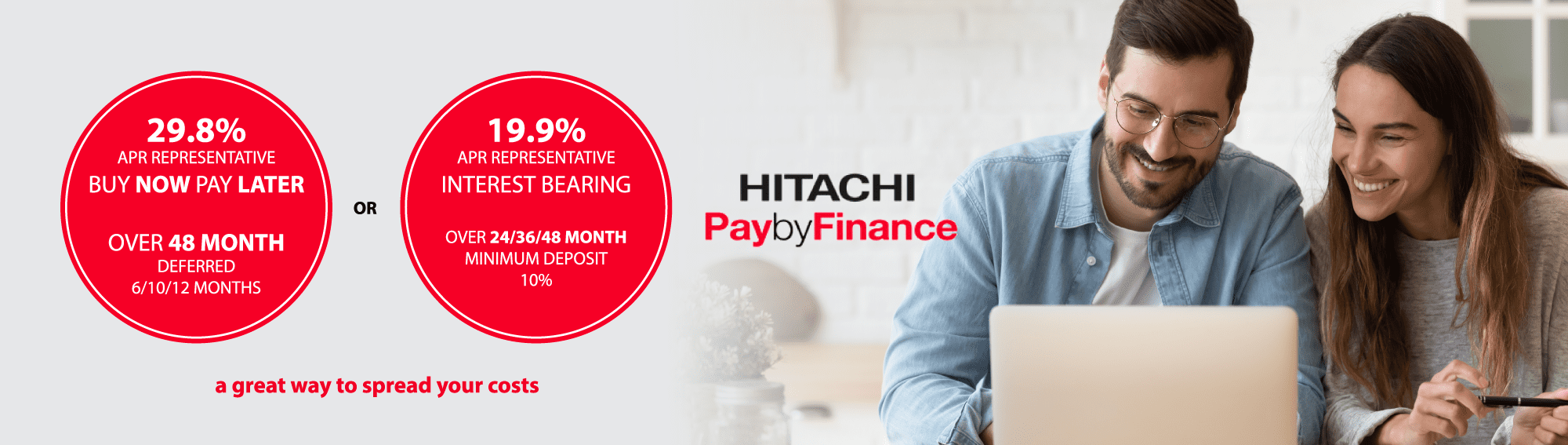

Buy now pay later finance

Buy now pay later with payments deferred for up to 12 months

Spread the cost with our buy now pay later finance available online and in store.

Our simple buy now pay later finance options allow you to spread the cost of your purchase over 48 months with an agreed deferral period.

Monthly repayments will start 6, 10, or 12 months after signing your finance agreement. Settle your agreement within the agreed deferral period and pay just an early settlement fee of £29.00.

-

All you need to do is:

- Spend a minimum £222.22 and above

- Place a minimum 10% deposit

- Minimum finance amount after deposit £200 and above

The table below shows you how much monthly repayments will be based on the total order value.

- Loan Amount

- £999.00

- Deposit (10%)

- £99.90

- Deferred 6 Months

- 48 Payments of £34

- Deferred 10 Months

- 48 Payments of £37.09

- Deferred 12 Months

- 48 Payments of £38.74

- Loan Amount

- £999.00

- Monthly payments

- £99.90

- Total charge for credit

- 48 Payments of £34

- Total amount payable

- 48 Payments of £37.09

Interest Bearing Finance

Up to 48 months 19.9% APR representative interest bearing finance

Spread the cost with our interest bearing finance available online and in store.

Our simple finance options allow you to spread the cost of your purchase over 24, 36 or 48 months.

-

All you need to do is:

- Spend a minimum £222.22 and above

- Place a 10% deposit

- Minimum finance amount after deposit £200 and above

Interest bearing finance allows you to choose a payment period to suit you. Either 24/36/48 Month options are available.

The table below shows you how much monthly repayments will be based on the total order value.

- Loan Amount

- £999.00

- Deposit (10%)

- £99.90

- 24 Months

- 24 Payments of £45.02

- 36 Months

- 36 Payments of £32.64

- 48 Months

- 48 Payments of £26.55

- Loan Amount

- £899.10

- Monthly payments

- 48 payments of £38.74

- Total charge for credit

- £960.42

- Total amount payable

- £1959.42

If you require any further information about finance please call 01282 443850

Credit subject to status and affordability. Terms & Conditions Apply. HARRY GARLICK THE T.V. CENTRE LIMITED trading as electricaldiscountuk is a credit broker and is Authorised and Regulated by the Financial Conduct Authority.

Credit is provided by Hitachi Personal Finance, a trading style of Hitachi Capital (UK) PLC, authorised and regulated by the Financial Conduct Authority. Financial Services Register no. 704348. The register can be accessed through http://www.fca.org.uk

- How do I choose to PaybyFinance?

- Who is eligible to apply for online finance?

- When do my repayments start?

- Are there any arrangement fees or hidden extras for credit?

- Applying for online finance

- Once my application is approved, what happens next?

- Will you credit score me and if so, what does this mean?

- If you decline my application, what is the reason?

- What type of information do credit reference agencies hold about me?

- How do I obtain a copy of this information?

- If my application is not successful, can I re-apply?

- Can I request delivery to an address other than my home?